HONG KONG: HOW TO FILE THE EMPLOYER’S RETURN FORM (IR56)

HONG KONG: HOW TO FILE THE EMPLOYER’S RETURN FORM (IR56)

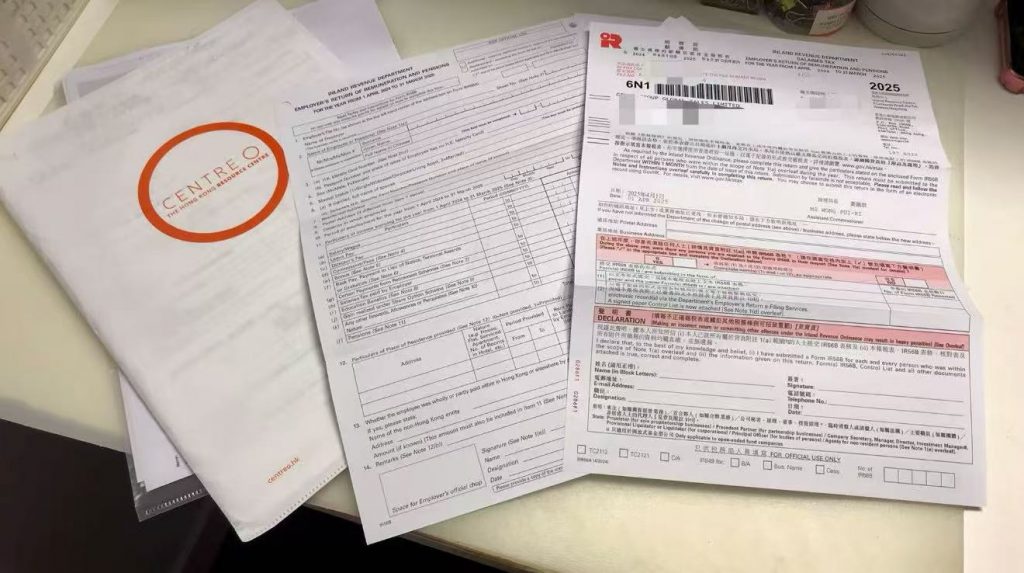

In Hong Kong, employers must report their employees’ income to the Inland Revenue Department (IRD) using Employer’s Return Form ( IR56) each year around the end of April or early May. Here’s a simple step-by-step guide:

1. Obtain the Employer’s Return Form

The Hong Kong Inland Revenue Departement (IRD) sends out the IR56B form every year in early April. This form is sent to your Registered Office address, if you have not received any by the second week of April, you should contact the IRD directly and request for a re-print and resend to your office.

2. Complete the Employer’s Return Form

Details that required from each employee:

- Employee;s full name

- Hong Kong Identity Card number or passport number

- Salary, bonuses, and allowances

- Any tax-deductible expenses or exempt income

Double-check all the details for accuracy, don’t forget the Employer has to also sign on the bottom of each attached forms.

3. Submission of the Employer’s Return Form

- Deadline: You must file the form within one month from the issue date, which the issuing date is on the upper right corner.

- Submission Methods:

- By Mail: Send it directly to the IRD.

- In Person: Drop it off at an IRD office.

4. Keep Records

Maintain a copy of the form and supporting documents for at least 7 years, as oyu will need to priovide them to the Auditor as well as the realted employee for their references.

5. Follow Up

After submission, the IRD may issue tax returns for employees. Make sure to inform your staff and keep proper records.

Avoid Penalties

Late or incorrect filings can lead to fines. Stay compliant with Hong Kong tax laws!

If you have any questions on the Employer’s Return Form, do feel free to contact us at sales@centreo.hk

You may want to read: How to pay tax in Hong Kong?