HOW TO CALCULATE MPF CONTRIBUTIONS?

HOW TO CALCULATE MPF CONTRIBUTIONS?

What is MPF?

MPF refers to “Mandatory Provident Fund”. Hong Kong started MPF system since December 2000 in response to the rapidly ageing population issue in Hong Kong.

How to calculate MPF contributions?

The MPF contributions have 2 parts: 5% from employee and 5% from employer. Totally 10% of employee’s relevant income. Moreover, the employers must make mandatory contributions for their employees with their own funds. The employers must also deduct the employee’s contributions from his/her relevant income for each contribution period.

Monthly Paid Employees

The current minimum and maximum relevant income levels are $7,100 and $30,000 respectively.

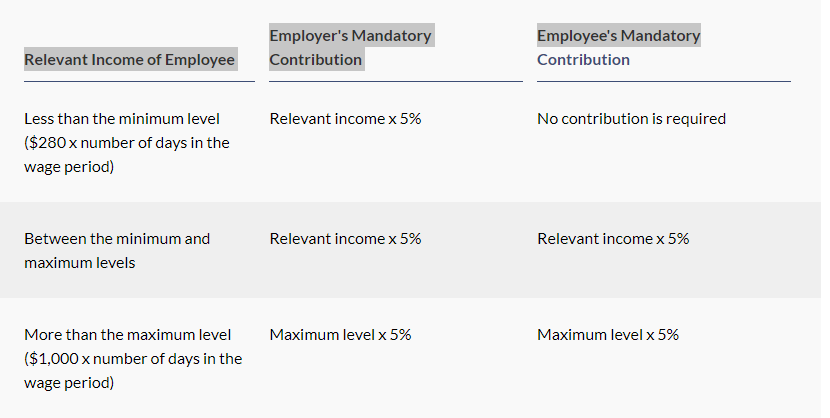

Non-Monthly Paid Employees

The employer must first calculate the minimum and maximum relevant income levels of the wage period. The calculation must base on the daily minimum and maximum relevant income levels of $280 and $1000.

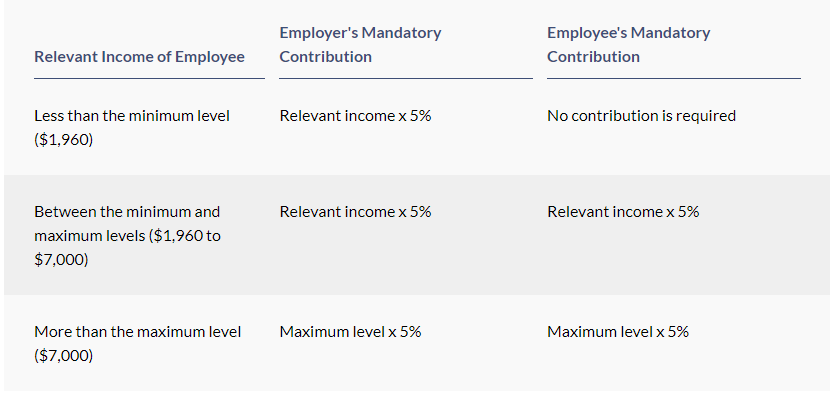

Weekly Paid Employees

The weekly maximum relevant income level is $7,000 ($1,000 x 7 days). Then the weekly minimum relevant income level is $1,960 ($280 x 7 days)

For further information, please contact us.

You may want to read: What is MPF ?